KB Financial Group (KB)·Q4 2025 Earnings Summary

KB Financial Delivers Record Shareholder Returns with KRW 1.2T Buyback

February 5, 2026 · by Fintool AI Agent

KB Financial Group reported Q4 2025 results that narrowly missed consensus estimates on a quarterly basis, but the real story is the aggressive shareholder return program. The South Korean banking giant announced KRW 1.2 trillion ($870M) in share buybacks, a 37.6% dividend increase, and achieved an industry-leading 52.4% total shareholder return ratio for 2025 .

Full-year 2025 net profit reached KRW 5.8 trillion, up 15.1% year-over-year, as one-off impacts from the 2024 ELS customer compensation faded and capital market-related gains expanded significantly . ROE improved to 10.86%, up 110 basis points from the prior year .

Did KB Financial Beat Earnings?

KB Financial narrowly missed both revenue and EPS expectations for Q4 2025. However, quarterly results were weighed down by sizable one-off items including approximately KRW 248 billion in group-wide ERP costs, KRW 263.3 billion in ELS penalty provisions, and seasonal contraction in insurance performance .

The full-year picture tells a different story:

For the first time in the group's history, the cost-to-income ratio came in below 40% on an annual basis, demonstrating significantly improved cost efficiency .

What Are KB Financial's Shareholder Returns?

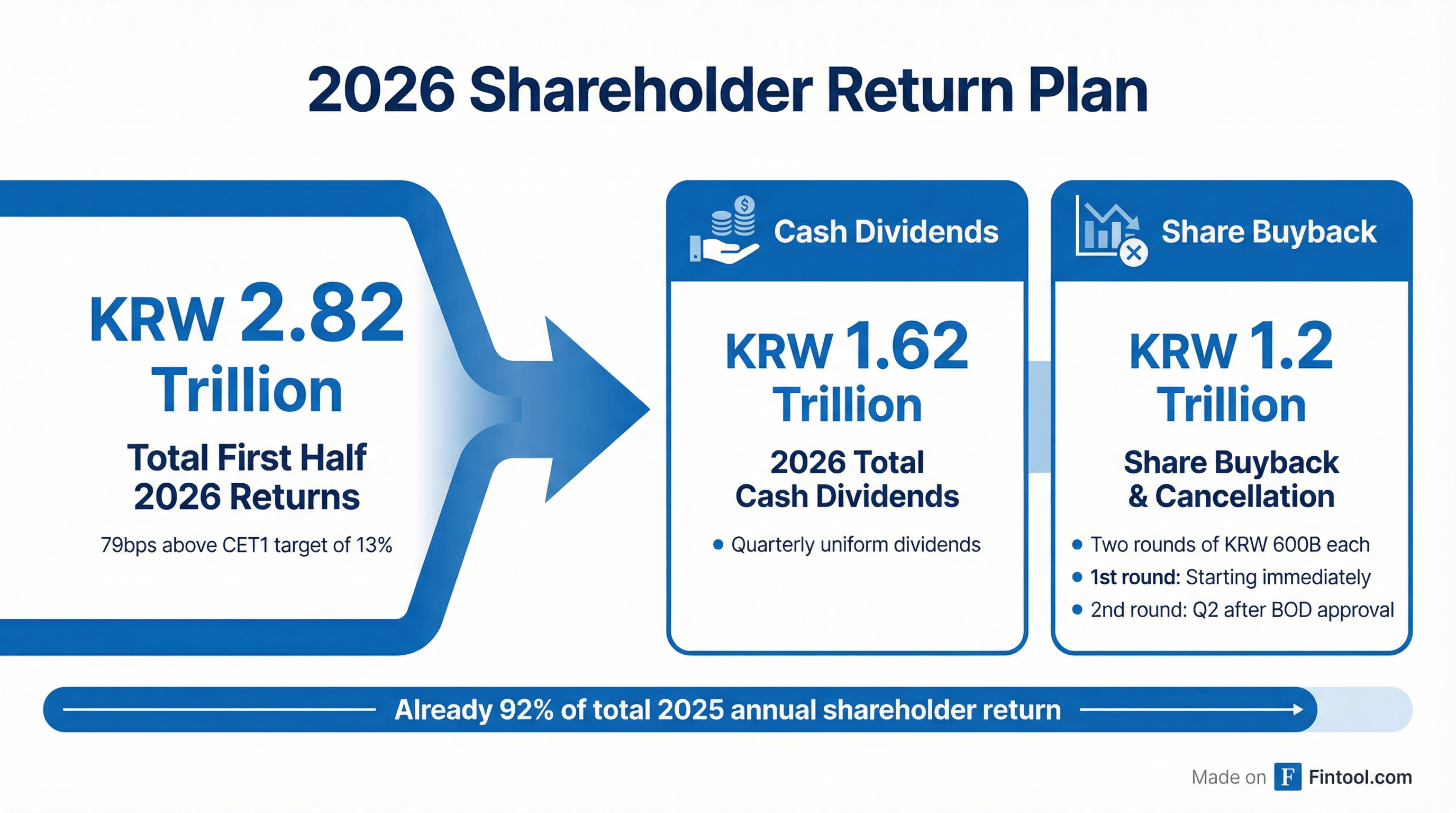

The headline announcement is the massive shareholder return program. KB Financial is returning KRW 2.82 trillion to shareholders in the first half of 2026 alone—already 92% of the total 2025 annual shareholder return .

Key shareholder return highlights:

- Total 2025 Shareholder Return Ratio: 52.4%, up 12.6 percentage points YoY

- Total 2025 Cash Dividends: KRW 1.58 trillion, up 32% YoY

- 2025 DPS: KRW 4,367, up 37.6% YoY

- Year-End Cash Dividend: KRW 1,605 per share (KRW 575.5 billion total)

- 2026 Share Buyback: KRW 1.2 trillion in two rounds of KRW 600 billion each

The board approved KRW 600 billion of share buyback to commence immediately after the earnings release, with the remaining KRW 600 billion scheduled for Q2 following an additional board resolution .

CFO Na Sang-rok explained the rationale for the elevated year-end dividend: "Given the quickly improving PBR improvement trends, we thought that there should be some changes to the mix of the means that we use for shareholder returns" .

What Is KB Financial's Capital Position?

KB Financial maintains industry-leading capital adequacy:

The CET1 ratio of 13.79% represents 79 basis points above the 13% target, providing substantial capacity for shareholder returns . Management noted that after accounting for the additional KRW 240.5 billion in year-end dividends (6 basis point impact), the effective CET1 ratio would be approximately 13.85% .

Risk-weighted assets grew only 3.3% versus year-end 2024, remaining within the target range through rigorous limit monitoring and portfolio adjustments .

How Did the Stock React?

KB Financial shares have rallied significantly over the past year, with the stock nearly doubling from its 52-week low of $46.38 to recent highs near $100. The current price around $94.64 represents a year-to-date gain of approximately 10%.*

The stock's PBR recently surpassed the 0.8x multiple, prompting management to reevaluate the shareholder return mix in favor of higher cash dividends .

What Did Management Guide for 2026?

Management provided detailed guidance across key metrics:

Net Interest Margin:

- Expect a gradual decline in NIM, with "low- to mid-single-digit level" decline for 2026

- Bank NIM was 1.75% in Q4 2025, up 1bp QoQ

- Will focus on low-cost deposit expansion and sophisticated ALM management

Loan Growth:

- Bank loan growth target: approximately 5% for FY2026

- Household loans: 2%-3% (limited due to government debt management policies)

- Corporate loans: 6%-7% (growth axis shifting toward productive finance)

Credit Costs:

- Expect stable credit costs in the "low- to mid-40s range" (basis points)

- 2025 credit loss provision: KRW 2.32 trillion, up 15.6% YoY, but reflects conservative provisioning stance

SG&A:

- Expect ~4% SG&A growth due to education tax increase

- Recurring expenses (excluding tax increase): approximately 2% growth

ROE Target: Management indicated plans to upwardly adjust the mid-to-long-term ROE target above 10%, noting: "We are targeting our ROE for more than 11% in the mid- to long-term" .

What Changed From Last Quarter?

Positive developments:

- Non-interest income surge: Fee income grew 6.5% YoY to KRW 4.1 trillion, driven by securities brokerage commissions and bank assurance/fund sales

- Capital market positioning: Non-bank subsidiaries now drive approximately 70% of group fee income, positioning KB well for the government's capital market activation policies

- Cost efficiency record: CIR hit an all-time low of 39.3%, breaking below 40% for the first time

- Shareholder return acceleration: Total shareholder return ratio jumped to 52.4% from 39.8% in 2024

Ongoing challenges:

- One-off items: Q4 net profit declined significantly QoQ due to ERP costs (KRW 248 billion) and ELS penalty provisions (KRW 263.3 billion)

- Household loan constraints: Government debt management policies continue to limit household lending growth

- NIM pressure: The base rate cut cycle creates ongoing margin pressure, though KB has partially offset this through funding cost management

Q&A Highlights

On the elevated year-end dividend: Management explained the surprise dividend increase was driven by three factors: (1) deferred shareholder return of KRW 190 billion from early 2025, (2) the introduction of separate taxation on dividend income under government policy, and (3) recent strong share price performance requiring upward adjustment of dividend yield .

On share buyback structure: The company chose to conduct buybacks in two separate KRW 600 billion rounds rather than one consolidated round because direct acquisition (preferred over trust acquisition) requires completion within three months. This approach ensures continuous share buyback activity throughout the year .

On capital reduction dividends: Management indicated preparations are "nearing completion" for capital reduction dividends, noting they plan to deliver "good news in this regard" in the near future .

On ELS penalty exposure: CFO noted that KB's exposure to the ELS penalty is "the largest" among peers, with KRW 263.3 billion provisioned. However, "given our earnings fundamentals and also the stance of the regulatory authorities, we are able to manage this issue without damaging our capacity." The penalty issue is expected to be "completely diffused within the year 2026" .

Key Takeaways

- Record shareholder returns: 52.4% total shareholder return ratio with KRW 1.2 trillion buyback and 37.6% dividend increase

- Strong capital position: CET1 at 13.79%, 79bps above target, supporting aggressive capital returns

- Non-interest income momentum: +16% YoY growth driven by capital market gains and fee income

- Cost leadership: CIR below 40% for first time in company history

- One-off headwinds clearing: ELS penalties and ERP costs to fully resolve in 2026, creating earnings rebound potential

- 2026 outlook: Corporate-focused loan growth (~6-7%), stable credit costs (low-40s bps), moderate NIM pressure

*Stock price data from S&P Global. Estimates data from S&P Global.

Related: